- Bearish Banter

- Posts

- No Rate Cuts? 2025’s Biggest Buzzkill!

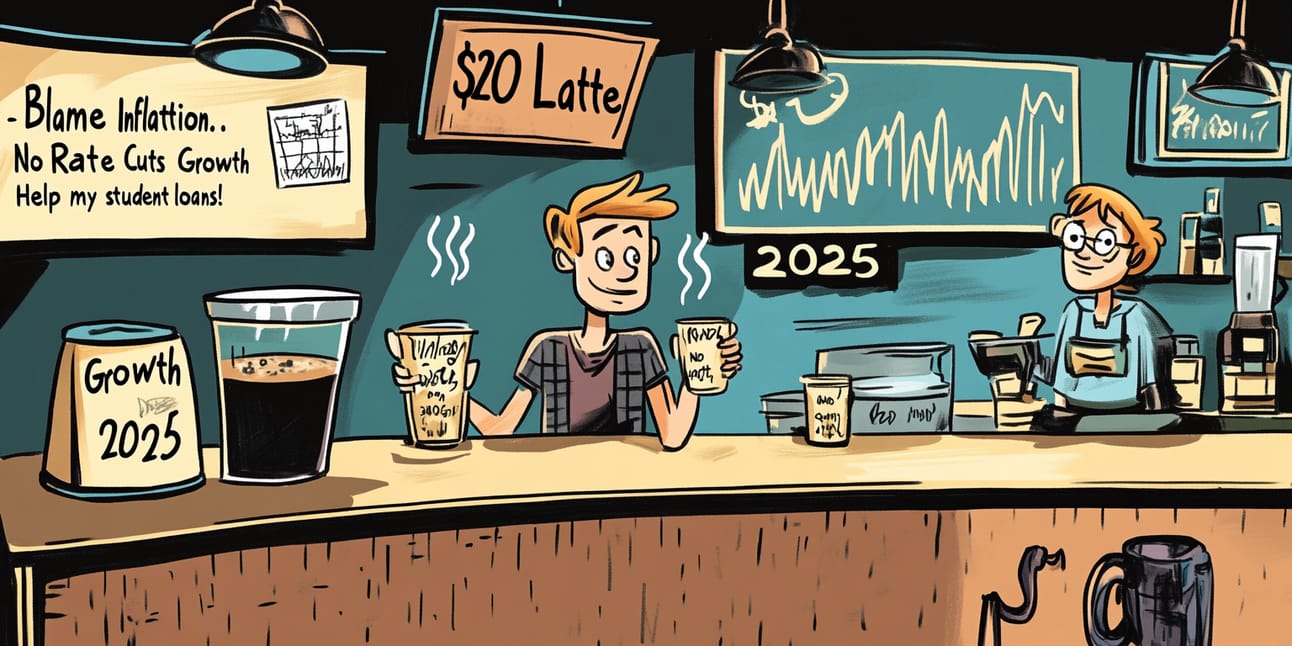

No Rate Cuts? 2025’s Biggest Buzzkill!

No Rate Cuts? 2025’s Biggest Buzzkill!"

Hey there, economic adventurers! Buckle up because we’re about to take a whimsical yet brutally honest rollercoaster ride through THE financial drama of 2025. No, it’s not about Elon Musk launching Dogecoin to the moon (again) or some billionaire buying a social media site for kicks—this one’s about something that really hits your wallet. Rate cuts. Or rather, the lack of them. I know, exciting, right?

The Tea on Rates and Why You Should Bother

You know that dream where you pay less interest on your mortgage, or your credit card bill doesn’t make you ugly cry? Yeah, spoiler alert—those dreams are on hold. According to Mr. “Fun Killer” Economist, there are no interest rate cuts coming in 2025. Why? Apparently, the economy is in beast mode—with growth roaring and inflation playing sidekick like an over-caffeinated intern. Sure, inflation might sound like a boring textbook term, but it’s the reason your $5 coffee now costs $6 (but still tastes the same, because life is cruel). Oh, and plot twist—goods minus food and energy prices are also climbing so fast, even your gym sessions aren’t raising your pulse as much.

How Does This Mess Impact Real People?

Now you may be asking, “Why should I care? I just work here.” Oddly enough, this is your story too. If rates don’t drop, borrowing cash to buy a house, car, or even that Peloton you plan to keep as a glorified coat rack gets pricier. But the good news? If you’ve stashed away cash in savings, you might actually earn something called “interest,” which people over 50 can explain was a thing before 2008.

On a macro note (fancy-talk for “the big picture”), businesses borrow less when rates are stubbornly high. That means fewer job opportunities or raises for you. Don’t be shocked if the office coffee fund vanishes entirely. Times are hard, Karen.

The Economic Wizardry at Play

It’s all about “quantitative tightening.” Sounds like a workout class, but it’s not nearly that fun. The Fed is hiking rates and holding onto bonds to curb inflation, which sounds noble, but here’s the plot twist—it might backfire and actually add to inflation. Funny, right? No? Okay. And let's not forget the federal government’s contribution to the chaos. Spending is up, defense budgets are soaring, and tax cuts are being dished out like party favors. Combine that with soaring interest on federal debt, and you’ve got the perfect storm for, oh, say… a fiscal crisis. Enjoy the fireworks, folks.

Everyday Tips to Survive This Saga

Worried? Don’t be! We’re here to help you laugh through your financial stress (and cry quietly later). Here are five cheeky tips to keep your head above water:

Kick Credit Card Debt Like a Bad Ex - Those balance transfer offers are your new best friends (until rates go up, too).

Invest in Inflation-Proof Options - Get cozy with assets like gold or Treasury Inflation-Protected Securities (TIPS), not to be confused with “leaving a tip,” which you should still do at restaurants.

Buff Up Your Emergency Fund - You might not get another rate cut, but surprise expenses will definitely show up, like a bad sequel to a bad movie.

DIY or Die Trying - Now is the time to YouTube your way through home repairs and car fixes. High-interest rate loans for that stuff? Forget it.

Side Hustle Like a Pro - Got some free time? Turn your love for knitting or gaming into extra income. Just avoid pyramid schemes unless you want a starring role in Netflix’s next true crime doc.

Original Source

This satire was lovingly adapted from "No Rate Cuts in 2025, Says This Economist. Blame It on Growth." in the Wall Street Journal.

Reply