- Bearish Banter

- Posts

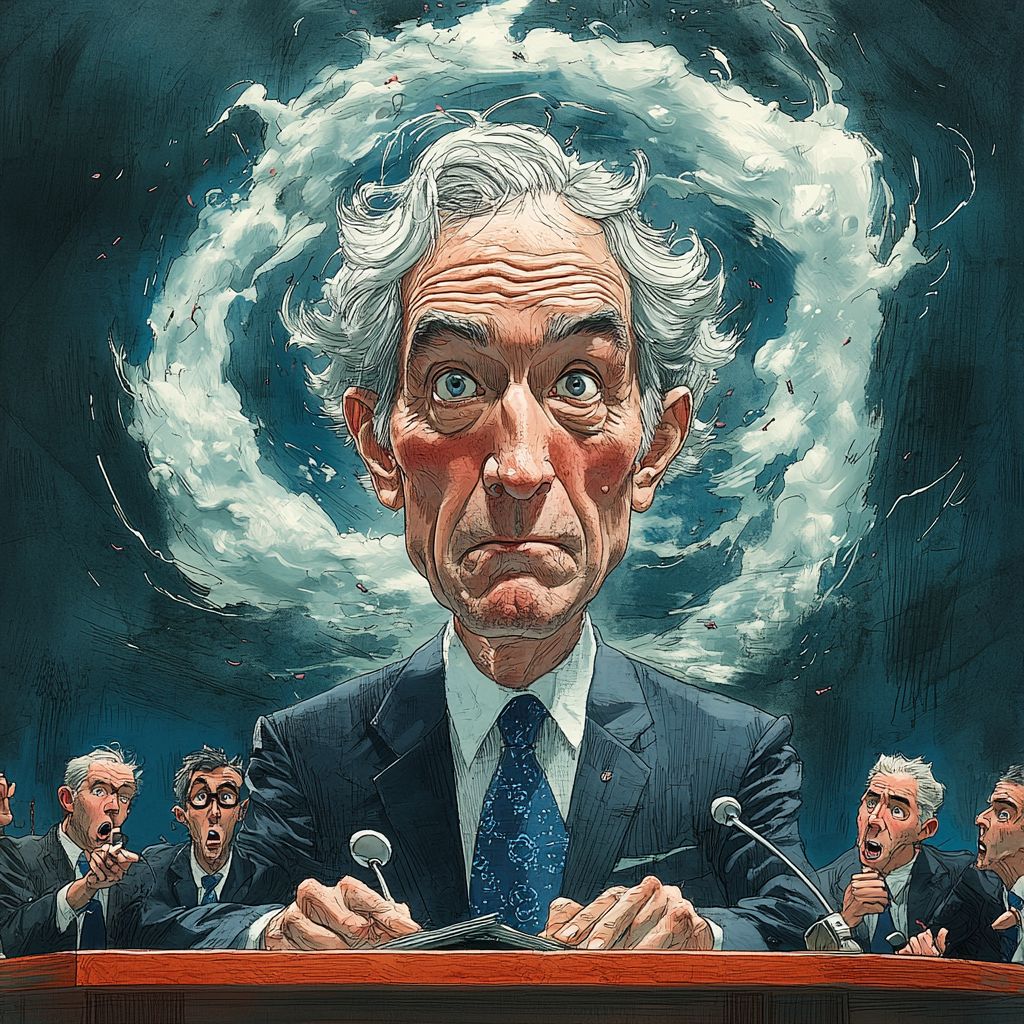

- When You Give a Fed Chair a Microphone

When You Give a Fed Chair a Microphone

Oh, the Federal Reserve, the dazzling tightrope walker of our economic circus. Last week, Jerome Powell took to the balancing act again, tossing interest rates, inflation numbers, and the fragile egos of stock market investors high into the air—juggling them like flaming torches. And sure enough, by the time his performance ended, Wall Street was clutching its pearls and fainting on cue.

You see, Chairman Powell did the unthinkable: he announced a pause on further interest rate cuts because, heaven forbid, the economy isn’t a piñata that he can whack with a stick every time Jay Powell Birthday Party Panic kicks in. And wow, did the stock market react predictably—or should we say, overreact like a soap opera villain discovering an identical twin.

The Dow, the S&P, and Nasdaq Take a Collective Nose-Dive

Picture this scene. Jerome Powell finishes a press conference, calm and composed, saying, “Look, inflation’s still a bit sticky, so don’t get your hopes up for more rate cuts anytime soon.” What does the Dow Jones do? It crashes, of course! Over 1,100 points in a single session. A 10-day losing streak—because investors, much like toddlers whose cookie has been taken away, are not about pausing anything.

Speaking of cookies—remember the children’s book When You Give a Mouse a Cookie? Investor behavior mirrored that beloved rodent last week. They're handed a signal that fewer rate cuts are in the cards and bam—they immediately demand even fewer. It’s like watching someone lose a cookie and then demand the cookie jar be emptied, put back on the shelf, and permanently locked.

Inflation Numbers Cooler Than Expected, Markets Still Hot-headed

The pièce de résistance of this melodrama? Friday’s inflation data. The November core Personal Consumption Expenditures Index (PCE—a term that’s so boring you’d think the Fed invented it on purpose) came in “a touch cooler than expected.” Great news, right? You’d think Wall Street would breathe easy, bust out the champagne, and reread Econ For Dummies.

Instead, stock markets temporarily rallied before realizing, “Wait, we’re supposed to be terrified all the time,” and promptly started second-guessing themselves again. Friday closed out with a Dow rally, putting on nearly 500 points. It's essentially the stock market equivalent of a cat that suddenly sprints across the room for no reason, only to pause and act as if everything’s fine.

Brinkmanship on Capitol Hill—More Drama to Spice Things Up

But wait, there’s more! Enter the U.S. government and its biannual tradition of budget brinkmanship, adding another layer of chaos like whipped cream on this already ridiculous economic sundae. This time, we had the House struggling to pass a spending bill to avoid a shutdown, which is basically like your drunk uncle at Thanksgiving trying to piece together a jigsaw puzzle upside down.

Bless Jerome Powell’s heart, though. Even amidst these Capitol Hill shenanigans, he stayed cool under pressure just like a high school substitute teacher presiding over a classroom of hormonal teenagers discussing Taylor Swift lyrics.

Congratulations, Jerome—You’ve Joined the Cast of "The Longest Stock Market Streak"

And now to the highlight of the week—the Oscars moment for our economic ensemble! Powell’s decision to pause rate cuts earned him the starring role in Wall Street’s longest losing streak in 50 years. Bravo to the Dow for method acting its way into this historic role of "disappointment," competing with the actual economic indicators that decisively showed…not a whole lot was wrong.

Meanwhile, economists are trying their best to interpret Powell’s signals. For example, Peter Boockvar, CIO at Bleakley Financial, waxed poetic about Powell’s comments by comparing investors to—you guessed it—not greedy Wall Street wolves, but mice. What’s next? Describing Nasdaq as a naughty puppy on a sugar rush?

A Wild Week, But Rest Assured, America’s Circus Goes On

Despite this thrilling rollercoaster of plummeting markets and balloon-popping announcements, nobody can deny this basic truth about economics—it’s inherently absurd. Between inflation rates that are “resilient” (which is economist-speak for “annoying and won’t go away”) and billionaires dabbling in government-stalling, you’ve got to admit that this whole system operates less like a well-oiled machine and more like a car held together by duct tape and wishful thinking.

Rest easy, though, as this week in financial chaos wraps up. Investors will forget their tantrums by next week, inflation will still be that persistent house guest who overstays their welcome, and Jerome Powell will undoubtedly step back onto center stage in his Fed Chair ringmaster get-up, holding his trusty microphone to keep the circus entertaining.

Citation

Satirical article inspired by "Forget the stock-market tumble, the Fed made the right move in a wild week" by William Watts from MarketWatch. Link to Article

Reply